The Polish zloty is strengthening: NBP cuts rates, dollar weakens

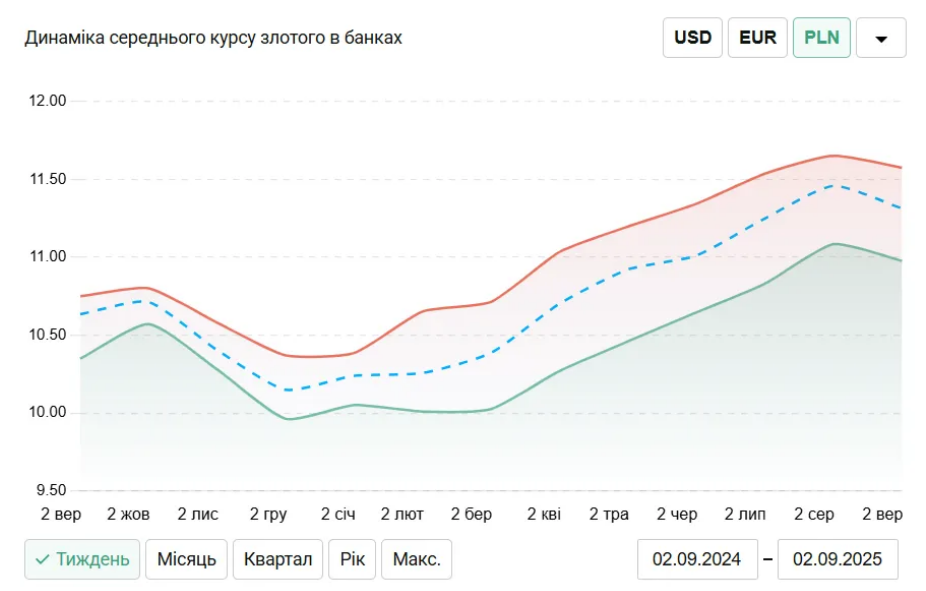

The Polish zloty continues to strengthen in the foreign exchange market, despite the National Bank of Poland's (NBP) key policy rate cut to 4.75%. The weakening US dollar is supporting the currencies of Central and Eastern Europe.

According to the European Central Bank, the exchange rate of PLN to EUR as of September 4, 2025 is about PLN 4.25 per EUR 1, which indicates the stability of the currency.

What's going on?

In September 2025, the NBP cut its key policy rate by 25 basis points to 4.75%, continuing to ease monetary policy. This decision is aimed at controlling inflation, which will remain stable until the end of the year.

The zloty gained 0.3% against the euro, similar to the Hungarian forint (HUF 393 per EUR 1) and the Czech koruna (CZK 24.45 per EUR 1). A weaker dollar (DXY ~98) and a 6.2% increase in Czech retail sales in December 2024 bolster the regional economy.

Significance for the economy

The NBP's rate cuts are balanced between curbing inflation and stimulating growth. According to PKO BP's chief economist, the bank avoids drastic changes by focusing on short-term forecasts. This contributes to the competitiveness of the zloty and attracts investors.

The main consequences:

Cheaper loans for business.

Potential rate cut to 4.5% by the end of 2025 if inflation remains low.

Strengthening regional currencies such as the forint and krona.

Impact on investors

The strengthening of the zloty affects the markets of Central Europe. The Prague and Bucharest stock indices are rising, while Warsaw and Budapest are experiencing a decline due to local factors. A weaker dollar reduces risks for exporters, making the region's assets more attractive.

Investors should:

Follow the statements of the NBU.

Consider diversification opportunities in Central Europe.

Political and regional context

The political situation in Poland has a significant impact on the stability of the zloty. After the 2023 parliamentary elections, the government has focused on economic stability, but possible changes in the government could affect monetary policy.

The rise of the zloty also reflects global currency developments, in particular the weaker dollar and the economic resilience of the region. The growth in Czech sales confirms these trends. Poland could become a leader in attracting foreign capital if the NBP remains flexible.

The strengthening of the Polish zloty is the result of the NBP's prudent policy and favorable global trends. This opens up growth opportunities for investors and businesses, but requires vigilance to political and economic signals.

Follow NBP news and regional trends to take advantage of the stable economy of Central Europe.

Recommended:

How to buy cryptocurrency

Bitcoin price forecast to $100,000

Changpeng Zhao's wealth increased by $3 billion during his imprisonment...

Why the US Federal Reserve rate decides the fate of Bitcoin and altcoins...

SWIFT changes the rules of the game: what awaits cryptocurrencies...

Revenues from Ethereum staking fell by 42% in half a ...

What is Ethena Finance? The essence of the synthetic dollar U...

The Hamster Kombat team has announced that the second season of ...

In 4 years, the largest inflow of institutional...

Ripple CEO predicts a reboot of the crypto industry...

The US Treasury wants to reduce the market of private equity...

Bitcoin has updated its historical maximum after the decision of the F...

Bitcoin rate soars: US authorities will buy up to 5% of B...

Europe cradles the Bitcoin rate: the pension fund of the Great...

Analyst Michael van de Popp predicts Bitcoin will reach $100...

Will Trump's victory affect Bitcoin's price?

Analyzing pumps in the cryptocurrency market

Ethereum ecosystem: preparing for a new breakthrough

Solana vs. Ethereum: who will win in the fight for De...

Cryptocurrency trends in 2024: what to look for...

CBDC: how digital currencies of central banks will change...

Bitcoin Jesus scandal: what happened to Roger...

Development of the cryptocurrency industry in Ukraine

$

USD₴

UAH

+38 (067) 544 40 40

+38 (067) 544 40 40